Apr 01, 2020 by Mark Dingley

The coronavirus, known as COVID-19, is putting Australian manufacturing businesses in uncharted territory. So how are you feeling about the impacts so far? What are your biggest concerns going forward? And how are you planning ahead?

The PKN Pulse survey, supported by Matthews Australasia, reached out to the manufacturing community to learn more.

Here’s what we found:

Unsurprisingly, the majority of respondents said the coronavirus was impacting their business to some degree.

When asked to what degree COVID-19 has affected their business operations, the average response was 6.3 out of 10, with 10 being “significant impact”.

Only 18% of respondents scored it 10 out of 10, which perhaps tells us that the real impact hasn’t yet been felt by most businesses.

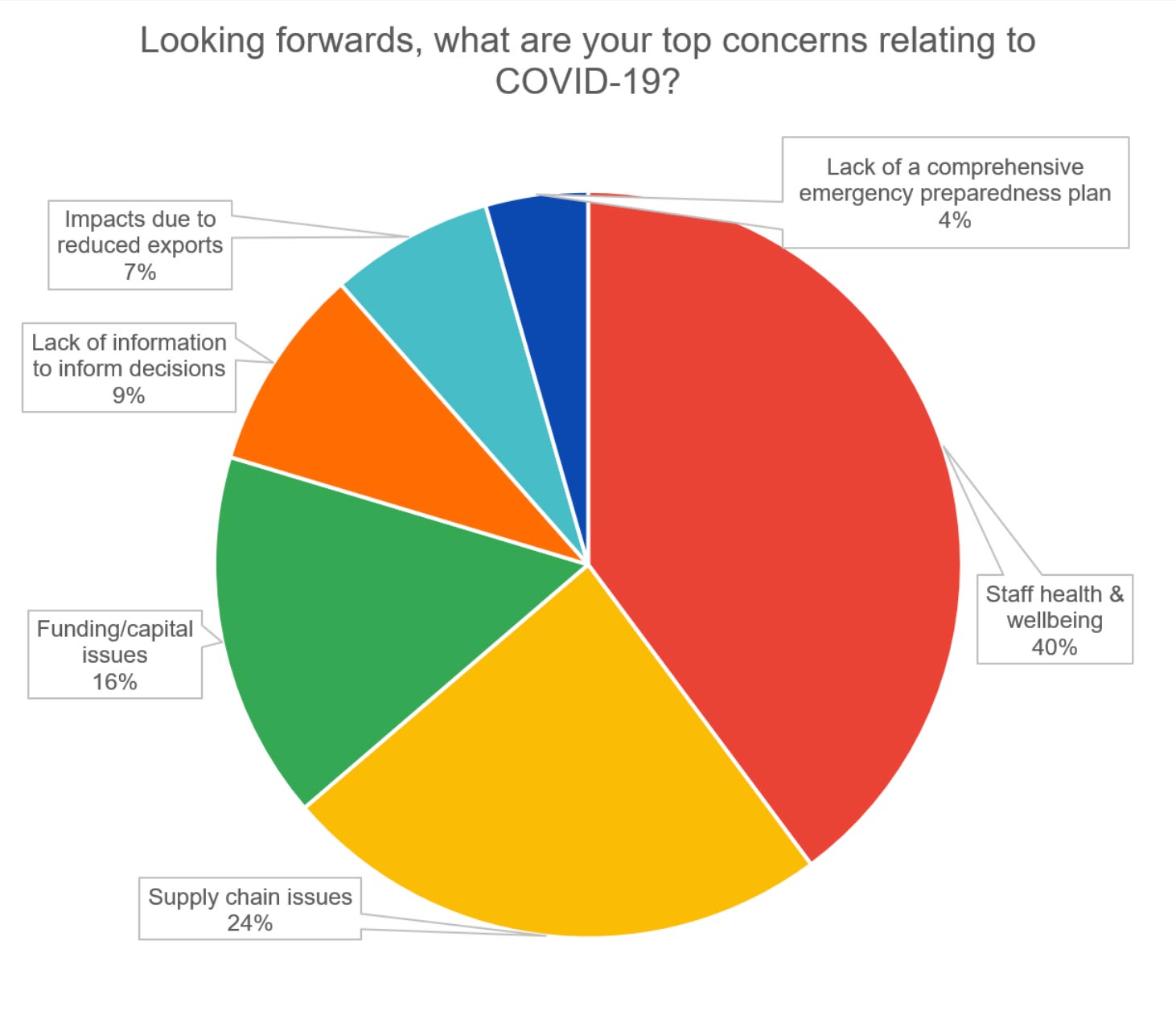

When asked their top concerns related to COVID-19 in the future, a staggering 93% cited staff health and wellbeing.

Employers play an important role in supporting the health and wellbeing of their staff, which extends from preparing the workplace for COVID-19 to minimising workplace stress. But there’s definitely confusion around employers’ specific obligations to protect workers from COVID-19, and some employers have to make challenging judgement calls.

The role of the employer is to provide clear information about health risks, instructions around ways to minimise those health risks and take steps to mitigate the risks the COVID-19 presents. Check out Safe Work Australia for up-to-date information.

For 56% of respondents, supply chain issues are a top concern related to COVID-19 in the future.

Though only a quarter (25%) said their inbound supply chain (such as ingredients, packaging, equipment) had been significantly impacted up to now, scoring it 8 or more out 10.

One respondent explained how, while their supply chain hasn’t been impacted yet, they know it’s coming: “A lot of our supply sees a 12-week lead time, so we are yet to see a full impact on supply. We are surely nervous.”

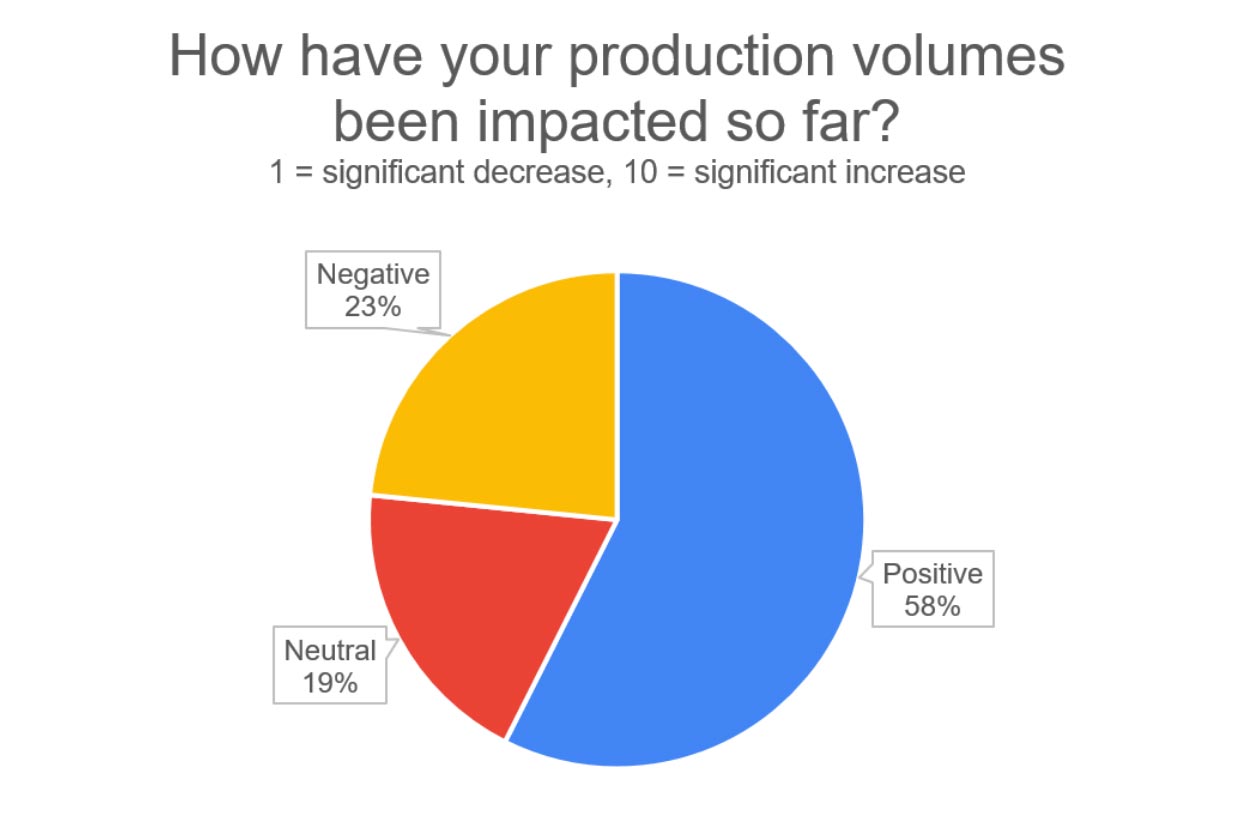

More than three-quarters (77%) reported that their production volumes areeither unchanged or have increased as a result of COVID-19.

In fact, 55% reported that their production volumes have increased.

Depending on the product, that’s not surprising. Manufacturers of toilet paper, tissues and hand sanitiser boosted production to keep up with a surge in demand in early March. Reports confirmed that Kimberly-Clark's Millicent mill in South Australia's south-east and Adelaide hand sanitiser and disinfectant manufacturer Arturo Taverna stepped up production.

More than three-quarters (77%) reported that their production volumes areeither unchanged or have increased as a result of COVID-19.

In fact, 55% reported that their production volumes have increased.

Depending on the product, that’s not surprising. Manufacturers of toilet paper, tissues and hand sanitiser boosted production to keep up with a surge in demand in early March. Reports confirmed that Kimberly-Clark's Millicent mill in South Australia's south-east and Adelaide hand sanitiser and disinfectant manufacturer Arturo Taverna stepped up production.

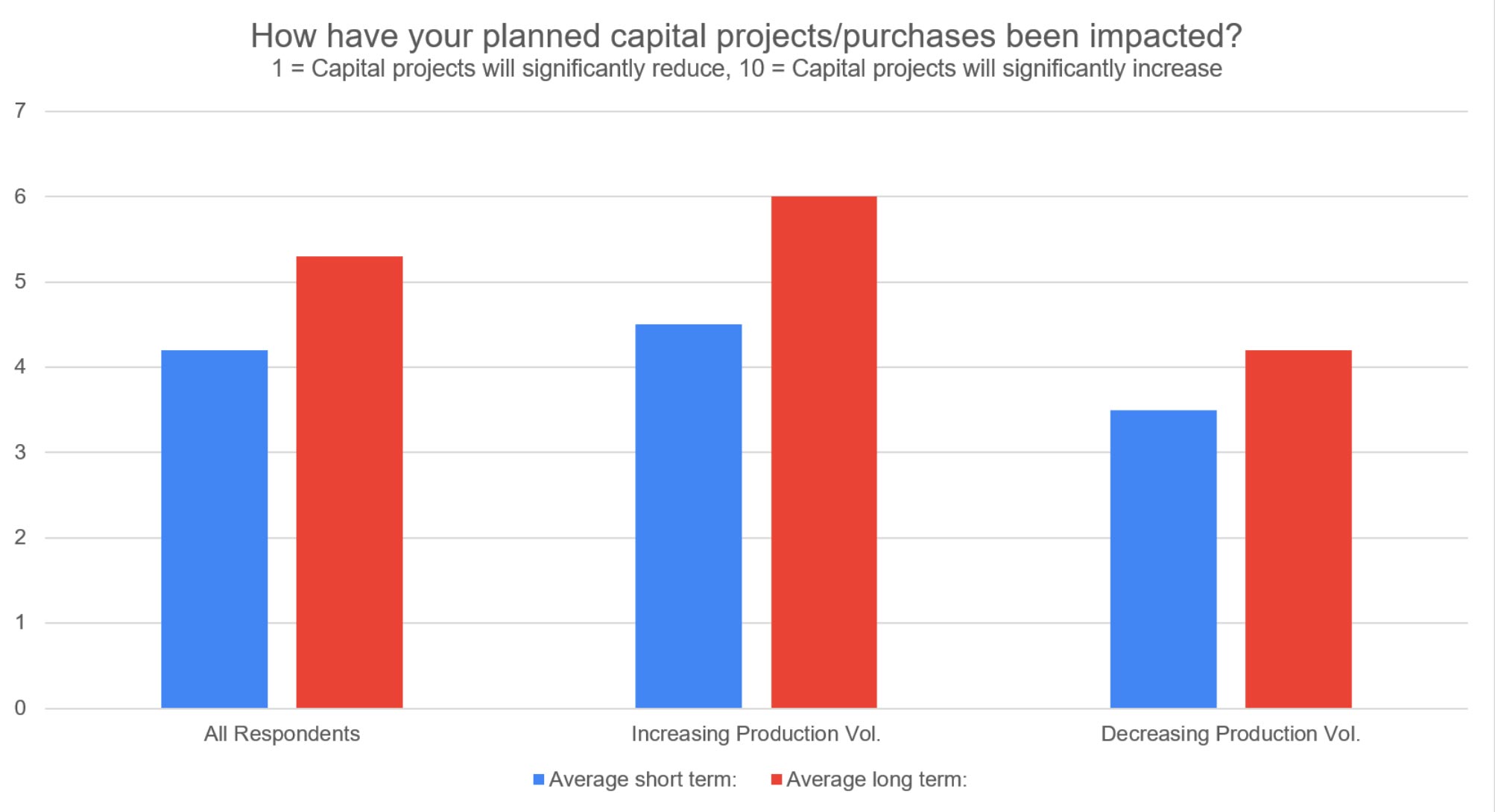

Respondents said planned capital projects and purchases will increase in the long term (12 months+), with 5.3/10on average.

Companies with increased production volumesplan a stronger increase than average (6/10).

Australian Government’s $17 billion economic stimulus package for coronavirushas been designed to ease the economic impact of the coronavirus. The stimulus package covers tax breaks and subsidies for small businesses over the next four years, including a huge expansion of the Instant Asset Tax Write-off scheme.

For the majority, the economic stimulus Instant Asset Tax Write-off is something they maybe or definitely plan to utilise. Only 29% do not plan to utilise it at this stage, 31% said they will utilise it, and 40% said maybe.

Of course, in the days since the survey, the situation has evolved rapidly. The Australian Government has unveiled a fortnightly subsidy to help pay workers’ wages, while also tightening the rules around social gatherings, limiting them to two people.

We’ve also seen companies become more agile in their business operations, with gin distilleries like Archie Rose, Four Pillars and Cape Byron Distilleryswitching to hand sanitiser to meet demand and keep their staff in work. More companies are also likely to begin updating strategies and shifting their business response.

The big question is how is your business adapting?

PKN conducted this survey during the week of March 23, 2020. The results are based on 48 responses.