Mar 24, 2020 by Mark Dingley

Fancy a G&T without the G? How about a Moscow Mule without any kick? Well, thanks to a freshly launched Aussie company, you might be in luck.

The days of ‘an orange juice for the driver’ are well and truly over.

Australia's love affair with alcohol appears to be waning, with more young people choosing to give up the booze. Aussies drank the equivalent to 186 million litres of pure alcohol in 2016-17, or just under 10 litres for every person in the country aged 15 years or over, according to the Australian Bureau of Statistics (ABS). Incredibly, it was the lowest annual figure since the early 1960s and it is a trend that is gaining momentum.

Research from La Trobe University analysed data from 120,000 Australians from the national Drug Strategy Household Survey and found one-third of adults said they had reduced how often or how much they drank in the past year.

A further 29 per cent said they had reduced the frequency of their drinking and 6 per cent said they had kicked the habit for good.

Those aged between 24 and 29 were the most likely to have reduced their alcohol intake, citing work, education and family as motivators for the change.

Research has found that 66% of 21-34 year old alcohol drinkers in Australia are making an effort to reduce their overall alcohol intake. One of the primary reasons for cutting back on alcohol is being more health conscious.

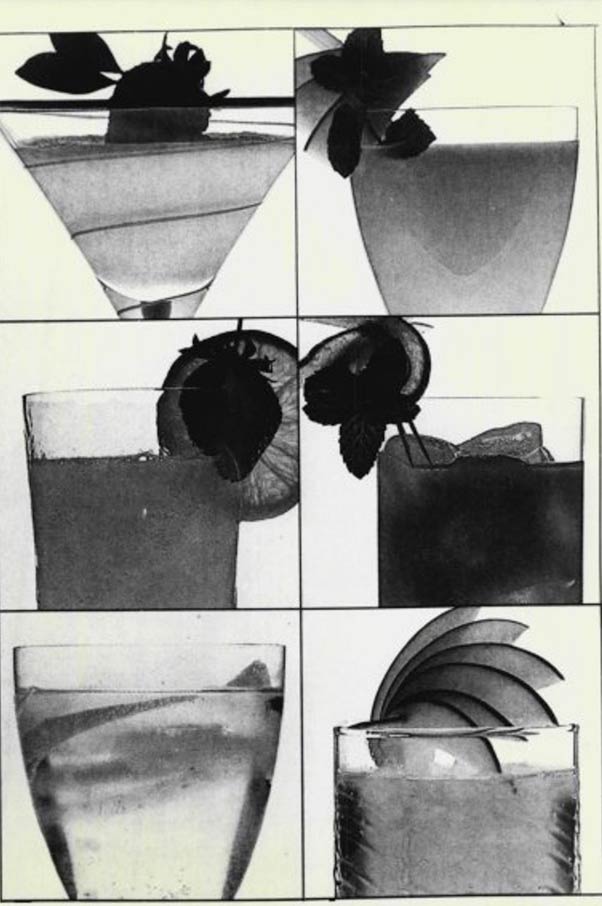

Non- and occasional drinkers are propelling a demand for choice in the ‘no’ and ‘low’ alcohol categories. What started off in the bars of London and New York is now finding its way into our homes with a raft of wines, spirits and beers that come without the proof, but with all the flavour. And that’s welcome news for those giving alcohol a miss; those who have found themselves stuck nursing a fizzy water now have a far more sophisticated range of drinks to choose from.

As the low- and no-alcohol trend continues its unstoppable rise, we round up the latest zero-alcohol ‘spirits’ offering an alternative to booze.

The UK is a far more developed market for non-alcoholic options. Almost every bar or restaurant in London has some form of non-alcoholic beverage available, beyond simple serves like lemon, lime and bitters. We are, however, seeing forward-thinking Australian hospitality operators really start to refine their options for no- and low-alcohol drinks options, and we’re happy we can be part of this change.

In the US, low- and no-alcohol brands are only 0.5 per cent of the total alcohol market, according to IWSR, but 52 per cent of adults have or are reducing their alcohol intake. But according to The Wall Street Journal, while overall beer sales stagnate, no-alcohol beer sales have grown 3.9 per cent on average for the past five years and are the fastest growing segment in the beer category. AB Inbev’s Budweiser Prohibition Brew, with no alcohol, is currently being tested in some US markets.

The IWSR report notes that Spain is one of Europe’s largest and most well-established markets for low- and no-alcohol beverages, led by beer and mixed drinks. Alcohol-free beer on tap is available in most Spanish bars. Alcohol-free beers in Spain are called sin-alcohol and many varieties come with lemon or other citrus fruit flavourings.

In a country with a very strong aperitif lunch culture, led by vermouth, there’s now Vermut Sin. And for the sobremesa (after-dinner chat) intrinsic to Spanish dining, there are now sin versions of the chupito, a shot-glass sized digestif, that comes in an array of flavours. In fact, many venues are now making their own versions.

According to Mark Livings, CEO of non-alcoholic-spirits brand Lyre’s, the rise of these kinds of pubs shows a broader consumer trend towards mindful drinking.

But we’re not just talking about low-abv beers and ciders, we’re also talking about non-alcoholic spirits.

A continuance of the heightened health awareness among consumers has shone a light on low- and no-alcohol drinks. While alcohol-free cocktails aren’t everyone’s cup of tea, Livings tells SmartCompany he believes he’s hitting the market at exactly the right time, pointing to a “tectonic shift” in how humans are consuming alcohol.

Decent alcohol-free serves have become a regular bar menu fixture in the haute cocktail scene, with rising demand for booze-free serves being spearheaded by the younger generation.

The likes of London bars Dandelyan, Nine Lives and Duck & Waffle have adapted to the trend, adding carefully curated non-alcoholic and low-abv libations to their lists.

It’s no surprise that the bigger drinks producers are looking for a slice of the teetotal action. Diageo holds a minority stake in Seedlip, the “world’s first” distilled non-alcoholic spirit,while Pernod Ricard recently entered the realm of alcohol-free spirits after agreeing to a distribution deal with Ceder’s, which is made in Sweden.

In Australia, while non-alcoholic beer represents the largest share of the low- and no-alcohol market, it is actually expected to decline by 0.1 per cent to 2022, where low- and no-alcohol distillates (spirits) are predicted to grow 28.6 per cent. The launch of Lyre’s range of non-alcoholic spirits in April is indicative of this.

Beer isn’t giving up, though. AB InBev recently announced it wants to increase the percentage of its sales coming from low- and no-alcohol beer to 20 per cent by 2025.

Adult non-alcoholic soft drinks are also on the rise, as are alcohol-free online retail specialists such as Alcofree.

According to IRI’s Moderation & Abstention report, the liquor abstention rate is currently 20 to 23 per cent of the adult population and rising long term, as is temporary abstention for events such as Dry July, Ocsober and the traditional January post-Christmas-blowout temperance period.

Australians’ interest in leading a healthier lifestyle can also be seen in the rise of veganism and vegetarianism and, according to Livings, the increase in no- and low-alcohol options is a reflection of that.

Our multicultural population, which includes Asian and Middle Eastern ethnicities which often practice abstinence or embrace a moderate drinking culture, has partially been behind the rise of low- and no-alcohol, as well as millennials who are more wellness-focused than preceding generations. A La Trobe University study of 120,000 Australians found one-third said they had reduced frequency and quantity of alcohol consumption in the past year, with those aged 24 to 29 the most likely to have reduced intake. The Australian Bureau of Statistics has found that Australian annual alcohol consumption levels are at their lowest since the early 1960s.

On the other hand, Australians are still among the heaviest drinkers in the world, at 10 litres of pure alcohol per person annually, more than the Americans or the Japanese. So the traditional Aussie pub isn’t going anywhere soon. But it may offer a better range of mocktails.

Seedlip is responsible for disrupting the non-alcoholic spirits category, offering a “sophisticated alternative” to alcoholic drinks.

Founded by entrepreneur Ben Branson, Seedlip is blended and bottled in England and has three products in its range – the inaugural Spice 94, the “green and floral” Garden 108, and the newest addition to the portfolio Grove 42. It was also an appealing investment for one of the world’s biggest alcohol producer. Diageo announced its investment in Seedlip in 2016 through the group’s accelerator programme Distell Ventures.

Non-alcoholic Ceder’s, described as a “premium brand that contains all the flavours of gin without the alcohol”, was launched by husband and wife team Craig Hutchison and Maria Sehlstrom in early 2017.

Ceder’s ingredients are inspired by botanicals found in the Cederberg mountains, in the Western Cape of South Africa. The distilled botanicals are then blended with Swedish water before being bottled in Sweden.

Pernod Ricard has been appointed as the exclusive distributor and will market the range in the UK, which includes Ceder’s Classic, Ceder’s Wild and Ceder’s Crisp.

Drinks giant Diageo tapped into the trend for low- and no- with the launch of two “ultra-low-alcohol” pre-mixed gin and tonic sparkling beverages under its Gordon’s gin brand.

Both Gordon’s Ultra Low Alcohol G&T with a Hint of Lime and Gordon’s Ultra Low Alcohol G&T with a Hint of Grapefruit are bottled at 0.5% abv.

The two expressions are made from Gordon’s London Dry distillate and available from UK retailers

The Stryyk range is the brainchild of Funkin cocktail mixer founder Alex Carlton and targets 18 to 35-year-olds who “choose not to drink alcohol, are having a night off or mixing up their night”.

Both Stryyk Not Rum and Stryyk Not Gin are distilled and bottled in the UK.

Stryyk Not Rum is made using clove, oakwood and grapefruit, while Stryyk Not Gin combines juniper, rosemary and basil. Neither contain sugar, fat, carbs or artificial flavours and are described as “100% natural”.

According to a YouGov poll, this year at least 3.1 million Brits attempted to abstain from drinking alcohol for Dry January. No surprise, then, that many bars are adapting to the trend, adding carefully curated non-alcoholic and low-abv libations to their lists. “We all tend to take it slightly easier and healthier after indulging over the holidays, so it’s a great chance for us to recharge after a busy season,” says Walter Pintus, bar manager at Serge Bar at Serge et le Phoque in London.

One of those companies specialising in these non-alcoholic options is Melbourne-based Brunswick Aces.

The company launched in 2017 and produces non-alcoholic beverages which it calls ‘sapiir’. It has a non-alcoholic gin called ‘Spades’, as well as ‘Hearts’, which is inspired by mulled wines.

Brunswick Aces Co-founder and CEO Stephen Lawrence told Business Insider Australia in an email that the company started out as a project between neighbours “to create something we could all share and enjoy when some of us weren’t drinking.”

Now it exports to New Zealand and Singapore, with expansions set for the US and Europe in 2020.

But who exactly is going for Brunswick Aces’ product?

“The majority of our consumers are women over 25 years old but we see a broad cross-section represented in who enjoys our products,” Lawrence said. “The most interesting thing about our customer base is that the vast majority love to host and ensure their guests are well catered for, regardless of their preference for alcohol.

“Our sapiir was developed to bring our own community together and it’s great to see that it’s able to do the same for our customers and their communities.”

"The manufacturing inspiration we take is from traditional gin production, it’s just more difficult to extract without alcohol as that’s a better solvent," Lawrence says. "We have to individually distil each botanical flavour then blend them up at the end, as each botanical requires different processes to release the aromatic elements that we’re trying to extract."

A 700ml bottle will set you back $50, and for drinkers who aren’t strictly teetotal, Lawrence suggests pairing it with regular gin to create a lower alcohol Negroni or gin and tonic.

Older readers might remember ads from the 1970s and ’80s for a non-alcoholic product called Clayton’s, with the tagline: “The drink you have when you?re not having a drink”, featuring actor Jack Thompson (an interesting casting decision, given his fondness for the grog).

Back then, Clayton’s was pretty much the only brand out there promoted specifically as an alternative to alcohol because, back then, people weren’t all that interested in alternatives to alcohol.

Overall, it points to a wellness and self-care trend that’s sweeping the country—and brands are not only buying the next round, but they’re bringing good design.

But it’s non-alcoholic spirits that are really collecting attention. Back in 2015 (talk about prescient), Pearlfisher designed the branding and packaging for Seedlip, and they’ve since followed up this past year with two new offerings in the form of NOgroni, a ready-to-drink mocktail, and Æcorn, a line of non-alcoholic aperitifs. Design Bridge worked on Caleno, a no-booze take on gin distilled with juniper and spice botanicals, that pulls exotic colours from the Colombian founder’s rich culture and heritage.

Most importantly, none of these beverages would look out of place behind the counter of the bar, whether it’s a hole in the wall or something decidedly high-end. In design terms, many of these upstart brands are meant to resemble the real thing. Take Stryyk, for instance. Here’s an alternative vodka brand that hews ever-so-close to Absolut made from cucumber, apple, and coriander. All they need is the print ad campaign behind them.

These are Instagram-ready brands—take a look at the work RoAndCo did for euphoric beverage Kin. High Rhode is a sophisticated and herbaceous mixer while the pop-it-open-and-you’re-good-to-go Spritz gives off a warm glow. Both drinks try to recreate some of the buzz you would otherwise get with alcohol, just with adaptogens and nootropics.

While some of the beverages you could have at a sober bar might cost an arm and a leg, there are plenty of ready-to-drink mocktails like Highball. Again, here’s another polished, cosmopolitan line of drinks featuring G&Ts, spritzes, and mojitos, all using abstract geometric shapes that deconstruct the cocktail.

With the help of design and brand agency Path, The Original Free Drinks Company developed Highball, a ready-to-drink, alcohol-free line that stays true to the cocktail experience with authentic flavours.

Dark Cane Spirit, Dry London Spirit, Italian Spritz “All the botanical aromas you'd expect from a classic London dry gin, minus the alcohol.” The range includes Absinthe, Gin, Amaretto, Whiskey, coffee liqueur, white and dark rum, dry Vermouth, and Aperol. Livings says it took nearly two years of taste-testing and collaborating with Australian sommeliers and a German company to perfect the flavours.

Lyre’s is just four weeks old but is already in stores in Australia and the UK, with Livings locking in distribution deals with Dan Murphy’s, BoozeBud, and UK distributor Proof Drinks.

Source: https://ceders-alt-gin.com

Danish gin brand Herbie launched Herbie Virgin last year – a non-alcoholic product distilled with juniper, Danish apples, lavender and orange peel. Produced in Denmark, the spirit is described by Herbie as “the first non-alcoholic gin in the world” and is produced using the same production methods and equipment as the original Herbie expression.

Ben Branson, the thirty-six-year-old creator of Seedlip, a line of non-alcoholic spirits that is often likened to gin, walked into L’atelier de Joël Robuchon to talk alcohol-free booze. Unlike gin, Seedlip spirits are not made with juniper: Seedlip Garden tastes of peas, rosemary, and thyme; Seedlip Grove has flavours of orange peel and ginger; and Seedlip Spice tastes of cardamom and oak. Like gin, they are distilled and unsweetened—and Seedlip’s marketers suggest pairing them with tonic water. Try it at your local Liquorland!

Launched in Australia in 2019, Ceder’s is described as a “premium brand that contains all the flavours of gin without the alcohol”. It was launched by husband and wife entrepreneurs Craig Hutchison and Maria Sehlstrom in early 2017.

Ceder’s ingredients are inspired by botanicals found in the Cederberg mountains, in the Western Cape of South Africa. The distilled botanicals are then blended with Swedish water before being bottled in Sweden.

In Australia, Dan Murphy’s, Liquorland and Vintage Cellars are amongst those stocking the spirit. The range consists of three expressions: Ceder’s Classic, which is “akin to a classic gin”, with a flavour of juniper and floral hints; Ceder’s Wild, which contains juniper, ginger, clove and rooibos; and Ceder’s Crisp, made with juniper, citrus, cucumber and camomile.

“This is a growing and exciting area for Pernod Ricard UK and we are delighted to offer our customers and consumers a non-alcoholic gin alternative,” said Laurent Pillet, managing director at Pernod Ricard UK.

Described as a “Distilled Non-Alcoholic Botanical Spirit”, Vermont offers a Limon and Bloom varieties. Vermont Limon has a vibrant green citrus flavour profile with abundant Lemon and Lime notes underpinned by Juniper that gives it a soft spicy edge and a distinctly gin-like complexity. This is pure Lemon and lime bliss! It looks like gin, served like gin, and makes the perfect "G&T" without any naughty additives, artificial sweeteners, colours, flavours - 0% sugar, 0% alcohol. Pure Guilt Free pleasure. Works beatifically with tonic as well as classic cocktails likes sours or martinis.

While it’s not on shelves, Dan Murphy’s offers it straight from the supplier.

A fruit driven, alcohol-free spirt with berry, spice & lime characteristics. Botanicals: Strawberry Gum, Desert Lime, Honey Myrtle, Riberry, Cinnamon Myrtle, Woods & Bark. Tasting Notes: Strawberry Gum & Australian Desert Limes are a killer combination here. Desert Limes provide a tart, sourness on the palate and this blends deliciously with the intense berry aroma of the Strawberry Gum. The mouthfeel is silky & smooth but it’s sharp at the same time. The sour is balanced with just a little sweetness by the amazing native Honey Myrtle. Spicy characteristics are provided by Riberry & Cinnamon Myrtle, the latter leaving you with an electric tingle on the finish. It’s like nothing you’ve tasted before.

Fluère Original bursts with carefully selected botanicals that issue a complex yet balanced taste and ensure a unique after-bite that normally only alcoholic drinks have. Both Juniper and Lime peel give a bright and fresh character to the nose whilst the lavender and coriander add some herbal note’s.

A delicious non-alcoholic alternative to traditional gin, made from a combination of juniper, basil and rosemary. It's 100% natural with no sugar, no fat, no carbs and no artificial flavours. Simply Strryk an old favourite like a G&T or a Tom Collins, or use it as the base for a new creation.

Natural Distilling Co’s Hemp Gin is made using limonene, one of the leading organic compounds found in cannabis plants. The limonene adds an ultra-rich profile to the spirit, mingling alongside notes of juniper, mandarin and lime, and finishing with soft spice. Limonene is also found in citrus peel and is said to have anti-inflammatory properties which can be used to relieve stress and naturally decrease anxiety and depression.

Natural Distilling Co Hemp Gin and Hemp Vodka are available now limited quantities from the Aussie brand’s website linked below. Hemp Gin is priced at $96 a bottle while the Hemp Vodka goes for $77. Natural Distilling Co is also gearing up to release a Hemp Rum soon. Until then, check out the current spirit line up and discover the benefits of using Hemp.