Jun 05, 2024 by Mark Dingley

Hundreds of thousands of people worldwide are taking drugs like Ozempic to lose weight. So, what does it mean for the Australian food & beverage industry.

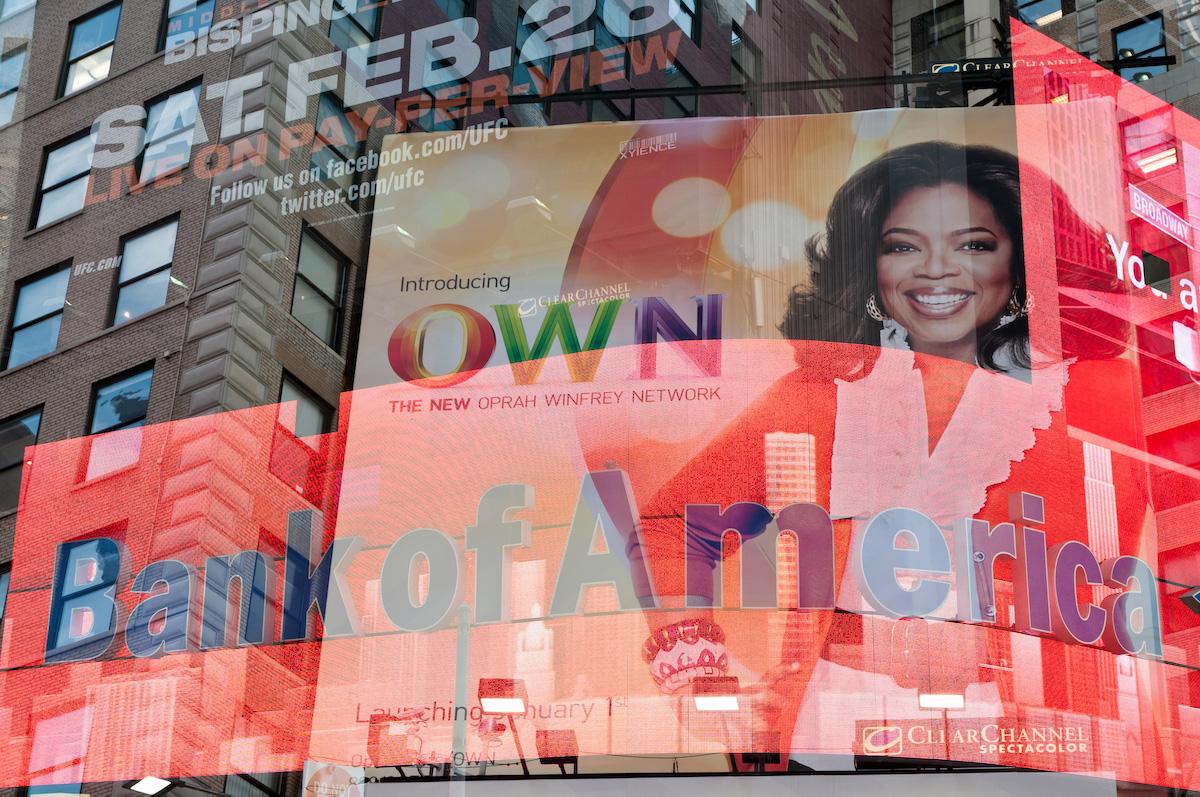

Ozempic, a drug used to treat diabetes, has been hitting the headlines as the likes of Oprah Winfrey and Elon Musk describe taking it to lose weight in record time.

It’s so popular that Dutch manufacturer Novo Nordisk (NVO) is scrambling to expand production sites to meet global demand.In February, its market value pushed over US$500billion, cementing its position as Europe’s most valuable company.

As Australian consumers begin to embrace the Ozempic movement, what does this mean for food & beverage companies?

Firstly, what is Ozempic? It’s an injectable medication used for treating diabetes. In Australia, it’s only approved for this purpose, but it is also marketed overseas for weight loss under the brand name Wegovy. The US Food & Drug Administration (FDA) has approved it for treating obesity.

Wegovy has a higher dose of the active ingredient in Ozempic, called semaglutide, and is also designed to be injected.

Semaglutide lowers blood sugar levels and regulates insulin, which is crucial for people with Type 2 diabetes. The drug also imitates a hormone called glucagon-like peptide-1 that our intestines produce naturally. This hormone limits our appetite by signalling to our bodies that we feel full, and prompts our stomachs to empty more slowly.

This new generation of weight-loss drugs also includes the US drugmaker Eli Lilly’s (LLY) Mounjaro, which is tipped to hit annual sales of US$35b by 2035.

These drugs have helped many people lose significant amounts of weight, but can cause side effects ranging from nausea, bloating, diarrhoea and fatigue to stomach, kidney and gallbladder problems, inflammation of the pancreas – and depression.

Morgan Stanley Research analysts estimate in a recent report that 24 million people will be using the drugs by 2035 – that’s 7% of the US population.

Obesity drug sales skyrocketed by 154% at constant exchange rates to 41.6b Danish kroner (AUD$9.11b) last year, fuelled by demand for Wegovy.

Their soaring popularity means shortages of the drug in the UK are expected to last until at least the end of 2024.

This is no surprise, given the posts and endorsements by celebrities and TikTok users using it for weight loss. When asked how he looked “fit, ripped and healthy”, Elon Musk tweeted that he was taking Wegovy.

Ozempic is already proving its potential to reshape consumers’ behaviours regarding food & beverage purchases.

The last quarter of 2023 became unexpectedly volatile for food, beverage and restaurant stocks after a report from Bank of America analysts in October outlined possible declining salesfor snacks, restaurants, tobacco, gaming, apparel and food retail companies, as consumers reduce their cravings. This caused a frenzy over the potential long-term impacts of these obesity drugs, which drove a share sell-off.

McDonald’s share price fell by 17% between the end of June and mid-October. However, it has since recovered and even announced a record global expansion.

Here’s how Ozempic and similar weight-loss drugs may impact the food & beverage industry:

Morgan Stanley analysts predict that as more people take weight-management medications such as Ozempic, the food, beverage and restaurant industries could experience softer demand, especially for unhealthier options.

The consumption of fizzy soft drinks, baked goods and salty snacks in the United States is estimated to fall by up to 3% by 2035.

According to the report, about 90% of those using the drugs said their snacking declined, 65% consumed fewer sugary carbonated drinks, and almost 20% gave up sugary drinks.

Morgan Stanley’s survey of US consumers using obesity drugs found that 77% visit fast-casual restaurants less often. This could be due to Ozempic’s appetite-suppressing effects and reduced cravings for unhealthy foods.

People taking Ozempic tend to eat less due to its appetite-suppressing properties. Some users report that their constant thoughts about food – otherwise known as “food noise” – diminish after taking the drug.

Walmart US CEO John Furner recently told Bloomberg that the company’s data indicated that customers who take Ozempic purchase slightly less food than the average population.

Some food-industry leaders have predicted that users will continue buying their favourite brands, just in smaller portions.

The alcohol industry may also be affected, with the Morgan Stanley study revealing that 62% drank less alcohol and 22% stopped drinking alcohol entirely.

Research shows that for some, the drugs don’t just curb food cravings, they also dampen the rewards of addictive substances such as alcohol.

The company estimates a 1.8% reduction in alcohol consumption from weight-loss drugs by 2025.

While this could threaten the alcoholic-beverages industry, it can also be an opportunity for low and zero-alcohol beverages, which have already seen an explosive rise in popularity over recent years.

Consumers using the drug will be looking for tasty and healthy versions of treats, meaning it could be worth food manufacturers investing in healthy, better-for-you meal and snack alternatives.

Steven Wood Presley, chief executive of Nestlé in North America, said that the drugs would create an opportunity for its Lean Cuisine meals: “That kind of meal is exactly what you’d end up eating on these kind of drugs.”

Companies that may benefit are those offering products or services that complement or support the weight-loss goals of users.

Nestlé is developing a range of health aids for users of weight-loss drugs, such as supplements, snacks and beverages containing protein, fibre and probiotics.

These supplementary products, also known as “companion products” or “fortification foods”, contain added vitamins, minerals and nutrients to help people meet daily nutritional requirements while eating less.

For many users, it’s not just what they’re eating that’s changing — it’s how. In one survey, users said they use portion control (45%) and cook at home (44%) more frequently since starting to take the weight-loss drugs.

This could bring opportunities for manufacturers of at-home meal kits, meal solutions and pantry items.

Food & beverage companies constantly evolve their products to adapt to consumer trends—just look at how the plant-based trend led to the rise of fake meat.

So, while it’s too early to tell precisely what Ozempic’s impact on Australian food & beverage companies will be, it brings plenty of opportunities for food & drink manufacturers to innovate and appeal to health-conscious consumers. In the meantime, watch this space.