Aug 12, 2020 by Mark Dingley

As the news about COVID-19 grows bleaker every day, there's one thing on everyone’s mind: sourdough.

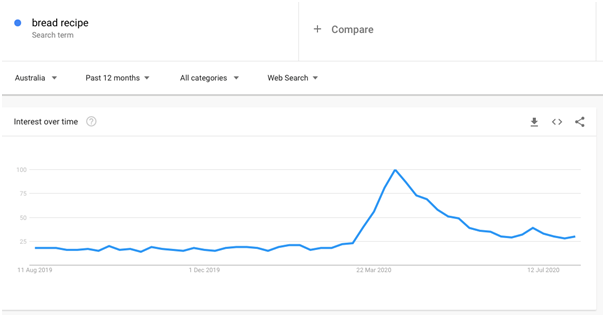

Google searches for bread recipes can be directly correlated to the coronavirus lockdowns in Australia.

The trend for baking sourdough is just one example of a niche that is soaring as a direct result of the pandemic. COVID-19 has had a dramatic impact on the food and beverages people buy.

Here, we've identified the top growth niches in the food and beverage industry during COVID-19.

Australia's organic industry is worth AU$2.6 billion, with a staggering 70% of Australians already buying some form of organic food.

Half of Australians claim their motivation for buying organic is based on personal health. So, it's no surprise that this sector is experiencing a surge during the COVID-19 crisis.

A report from Ecovia Intelligence states that organic sales have seen a "hefty sales increase" globally, with online retailers seeing the highest sales growth.

What's interesting about the current trend is that organic products are priced higher. So, even though Australians are experiencing a period of heightened price sensitivity due to tighter budgets, this hasn't stopped some from turning to organic products.

As fresh produce marketing specialist Lisa Cork said in her guest post, How COVID-19 has increased mindful consumerism, the big question consumers are asking right now is: "How do I ensure my family and I stay healthy amidst the first pandemic in our lives?"

This has led to a very specific rise in demand for foods and beverages perceived as immunity-boosting, such as probiotics and vitamin-rich products.

An FMCG Gurus study in May 2020 revealed that 72% of participants were concerned about their immune health, mostly in relation to their own health and wellbeing, with 71% associating probiotics with helping to support their immune health. There are huge growth opportunities here for manufacturers of kombucha and yogurt.

According to research by Mintel, two-thirds of British consumers believe that consuming vitamin C helps support the immune system, with almost 37% saying the COVID-19 crisis has prompted them to add to their diet more nutrients that support the immune system. Thanks to the surge in demand for vitamin-rich juices, companies including PepsiCo have reported a boom in their juice business.

Even basic fresh produce is experiencing growth – almost a quarter (23%) of consumers are eating more fruits and vegetables since the start of the outbreak. Some 31% of Gen Z (aged 20 and under) and 27% of millennials are most likely to keep their fridges well stocked with healthy produce, according to Mintel research.

Plant based diets were already experiencing a surge in growth in a pre-COVID world, and the pandemic has well and truly put this in the fast lane.

The Mintel research revealed that 25% of British millennials (aged 21–30) say that the COVID-19 pandemic has made a vegan diet more appealing.

This isn't restricted to the UK; In China, sales of the new plant-based meat options in KFC and Pizza Hut have skyrocketed.

Here in Australia, some brands are already on the front foot. Maggie Beer is launching a new plant-based prepared meal range called "Maggie's Food for Life" in Coles in October to target the fast-growing vegan category.

(Incidentally, Maggie Beer Holdings (ASX: MBH) has defied the economic downturn during the COVID-19 pandemic to post EBITDA growth of $5.3 million in FY20 – definitely a brand to watch!)

Another existing trend that is accelerating due to the pandemic is low alcohol beverages.

Pre-lockdown, one-third of adults said they had reduced how often or how much they drank in the past year, with 24 to 29-year-olds most likely to have reduced their alcohol intake. This had led to a rise in 'no' and 'low' alcohol products. We published an article about how Australia is following the UK trend for non-alcoholic spirits.

This trend has now evolved further. In research by the Australian National University, more Australians said they reduced their alcohol consumption during the coronavirus pandemic than increased it.

About one in five said they were drinking more as a result of coronavirus, compared to 27% who said they were drinking less.

The same trend was found in the UK – An Opinium survey found that one in three were trying to reduce or stop drinking alcohol during the lockdown, with 6% who stopped drinking altogether.

No doubt about it – this opens the door for low- and no-alcohol products.

When the pandemic first hit, a wave of panic buying swept across supermarkets in Australia. People were filling their trolleys with shelf-stable foods, such as soups, pasta, and long-life milk.

Panic buying may be over, but the lockdown has still impacted eating habits, with Mintel’s research showing that 37% of consumers believe that, in the future, people will buy long-life food and drink, such as UHT milk and tinned food, more often.

With bars, cafes and restaurants shut for months on end, many consumers have transferred their spending money to indulge in premium food and drink from the comfort of their own homes.

Those lucky enough to avoid job loss have found they have more disposable income. So, while stuck in lockdown, they spent on luxury foods, craft drinks, and other premium products.

Take a look at how brands are using premiumisation.

Home cooking and baking is on the rise. You only need to look at Instagram to see the growing popularity of cooking and baking during the lockdown – and we're not just talking about sourdough bread.

The interesting trend here is that, while older age groups (35 years and above) are losing their cooking momentum, we’ve seen younger Australians (16-35 years old) continue to try new meals at home, spend more time cooking from scratch and cooking more nutritious meals.

Before the pandemic, snacks were seen as a way to keep us full between meals or as a convenience meal replacement for busy professionals. But this has shifted as the lockdowns have continued.

Now, people are more conscious of what they are eating and have moved towards healthier snacks. The result is a lower demand for high-salt and sugary snacks, and a higher demand for healthier alternatives or even making snacks from scratch. After all, people have more time to cook and bake.

What trends are you seeing in the food and beverage sector right now?