Jun 27, 2025 by Matt Nichol

From adaptogenic chocolate to probiotic cookie dough, today’s consumers expect more from their food and drink. They’re not just buying nutrition, they’re buying energy, immunity, sleep support, stress relief and gut health in every bite or sip.

Australia already punches above its weight in the functional food & beverage category: we’re fifth globally for functional claims in food & beverage launches, and the local functional beverage market alone is valued at nearly $600 million, according to IBISWorld.

As more Australians prioritise health and wellbeing in their daily choices, local food & beverage manufacturers are in a prime position to lead.

In this article, we’ll explore what’s driving the functional food & beverage boom, the key trends to watch, and how Aussie manufacturers can capitalise on this growing demand.

A mix of long-term shifts and post-COVID behaviour has set the stage for explosive growth in functional food & beverage:

And the market is diverse. According to the International Journal of Environmental Research and Public Health (2022), the over-65s show strong interest in functional foods. As the global population ages, this represents a fast-growing segment.

Women are key drivers too. Euromonitor International notes that women are increasingly embracing holistic health solutions – particularly around menstrual and menopausal wellbeing – pushing demand for targeted functional options.

We’ve moved on from what’s not in a product (fat-free, sugar-free) to what is, and why it matters. Ingredient-led branding is back, and consumers are hungry for solutions that work.

Gut-brain connection: Products with prebiotics, omega-3 fatty acids and fermented ingredients to support both digestion and mental wellbeing.

Anti-inflammatory foods: Berries, turmeric and green tea are on the rise for their antioxidant properties, which help fight inflammation – a cause of many chronic diseases. Mintel says 36% of Australian consumers are willing to pay more for food and drinks carrying claims supporting immune system health.

Mood and stress support: Adaptogens are showing up in drinks, snacks and even desserts. According to Innova Market Insights, natural ingredients rising in prominence include mushrooms with adaptogen qualities, lion’s mane and seaweed ingredients, such as ashwagandha and other adaptogenic herbs.

Protein: Innova Market Insights research also shows that after vitamins, ingredients in the protein market are the secondmost important nutritional ingredient to consumers. More than one-third of consumers said they use foods & beverages fortified with protein, with growth being fastest in products with plant-based protein ingredients.

Hydration and cognition: Electrolytes and nootropics are fuelling the next wave of functional beverages.

Whether you’re developing new SKUs or upgrading existing ones, here’s where manufacturers are seeing success in the functional food & beverage category:

1. New product development: Launching standalone SKUs targeting specific outcomes such as “+focus” or “+sleep”.

2. Line extensions: Adding functional variants to core ranges (e.g., probiotic yoghurt, energy water).

3. Reformulations: Swapping out sugar for fibre or adding botanicals and native ingredients for a health halo. Flexible labelling and coding systems from Matthews can help streamline reformulation launches and ensure compliance with changing ingredient and health claims.

4. Private label and contract manufacturing: Helping retailers tap into the wellness trend with their own functional private label ranges.

Whatever your strategy, it starts with the consumer. Identify the benefit they care most about – gut health, energy or stress relief – and test functional extensions before investing in a full range. By putting the consumer at the heart of your business decisions, you can ensure that your products meet their needs and stand out in the market.

.jpg)

The growth of functional foods presents strong opportunities and unique challenges for manufacturers looking to stand out in a crowded market.

1. Scientific and regulatory hurdles

Consumers expect functional products to do what they claim, so brands must ensure that any benefit is backed by credible science and delivered at an effective dose. But making strong claims isn’t easy – FSANZ regulations are strict, especially around therapeutic benefits, so brands need to tread carefully. Getting it wrong can mean costly reformulations or reputational damage. Partnering with suppliers offering research-backed ingredients and formulation support is essential.

2. Consumer expectations and brand credibility

Consumers want food & beverages that work – but that also taste great. Overpromising or leaning too hard on wellness trends can backfire if the product can’t deliver. Focus on highlighting benefits clearly, but responsibly.

.jpg)

3. Targeting and differentiation

As the category grows, manufacturers must go beyond generic benefits to serve more specific needs, such as stress support, menopause relief or gut health. However, personalised positioning adds complexity in formulation, messaging and marketing.

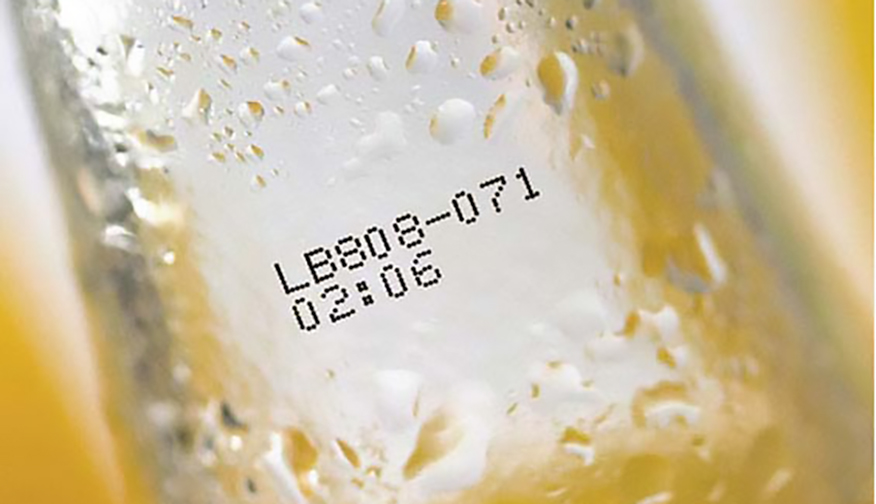

4. Operational flexibility and traceability

The functional food space moves fast, and so must your production. To respond quickly to trends and evolving health claims, manufacturers need flexible systems that can handle shorter runs, product customisation and frequent formulation or packaging updates.

Coding and labelling need to be adaptable, accurate and compliant. At the same time, growing regulatory and consumer scrutiny means end-to-end traceability is essential.

Matthews Australasia helps manufacturers stay agile with smart coding and labelling solutions, data capture, and end-to-end traceability systems built for compliance and speed to market.

Better-for-you isn’t just another health trend. It’s a fundamental shift in how Australians buy, eat and live. Manufacturers who combine credible science with innovation, speed and flavour stand to win big in a market that’s fast gaining momentum.

With Matthews Australasia as your partner in coding, labelling, and traceability, you can respond to demand with speed, confidence and compliance.